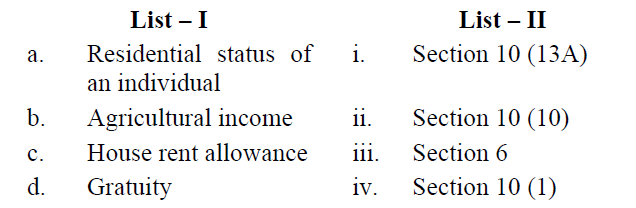

Match the items of the List – I with those of the List – II and indicate the correct code :

| A. | i iii ii iv |

| B. | iii iv i ii |

| C. | ii i iii iv |

| D. | iv ii i iii |

|

Option: B Explanation : Click on Discuss to view users comments. |

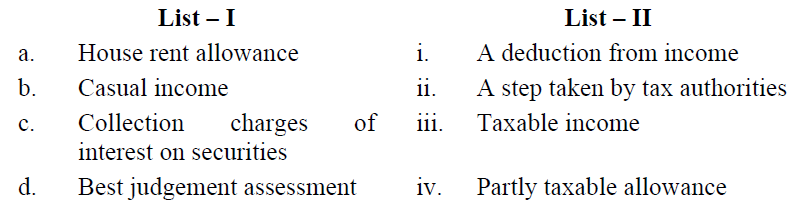

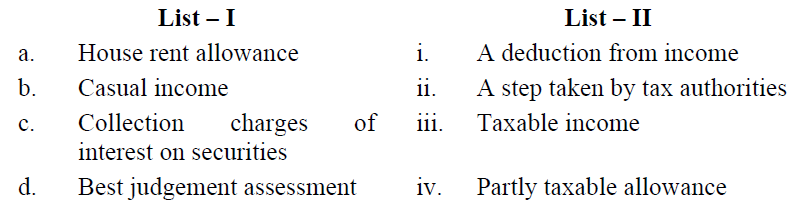

Match the items of the List – I with List – II and indicate the correct code :

| A. | iv iii ii i |

| B. | iv iii i ii |

| C. | iii iv i ii |

| D. | ii iv i iii |

|

Option: B Explanation : Click on Discuss to view users comments. |

The statutory limit for deduction u/s 80 GG of Income tax Act, 1961, for the assessment year 2015-16 is

| A. | Rs 2,000 per month |

| B. | Rs 3,000 per month |

| C. | Rs 2,500 per month |

| D. | Rs 5,000 per month |

|

Option: A Explanation : Click on Discuss to view users comments. |

For the purpose of assessment under Income Tax Act, 1961, which combination of the following represent income ?

(I) Tax-free salary from the private sector employer.

(II) Pin money received by a family member.

(III) Awards received by the sports persons.

(IV) Loss incurred by the assessee.

(V) Perquisites received by employees.

Codes :

| A. | (I), (II), (III), (IV) |

| B. | (II), (III), (IV), (V) |

| C. | (I), (III), (IV), (V) |

| D. | (I), (II), (IV), (V) |

|

Option: C Explanation : Click on Discuss to view users comments. |

| A. | (a), (b) and (c) |

| B. | (b), (c) and (d) |

| C. | (a), (b) and (d) |

| D. | (a), (c) and (d) |

|

Option: C Explanation : Click on Discuss to view users comments. |