The following is the demand function :

Q = 100 - SP

What will be the point price elasticity of demand at price Rs 10 ?

| A. | 2.00 |

| B. | 1.00 |

| C. | 0.85 |

| D. | 0.50 |

|

Option: C Explanation : Click on Discuss to view users comments. |

| A. | 20 |

| B. | 15 |

| C. | 10 |

| D. | 5 |

|

Option: B Explanation : Click on Discuss to view users comments. |

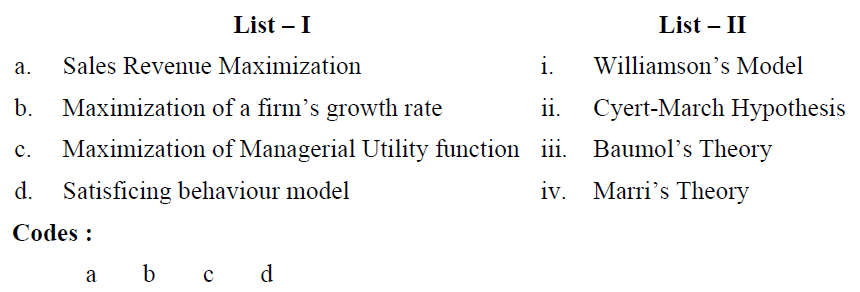

| A. | iii iv i ii |

| B. | i ii iv iii |

| C. | ii iii i iv |

| D. | iv iii ii i |

|

Option: D Explanation : Click on Discuss to view users comments. |

Assertion (A) : The perceived risk of operating a domestic firm in international environment is much higher.

Reason (R) : The international environment is more volatile and the domestic firm generally does not have full information about the environment.

| A. | Both (A) and (R) are correct. |

| B. | Both (A) and (R) are incorrect. |

| C. | (A) is correct while (R) is incorrect. |

| D. | (A) is incorrect while (R) is correct. |

|

Option: B Explanation : Click on Discuss to view users comments. |

Statement – I : The accept-reject approach is adopted generally when a firm has a large amount of funds to invest in several projects at the same time.

Statement – II : Both the NPV and the IRR methods of investment appraisal are based on discounted cash flow approach.

| A. | Both the statements are correct. |

| B. | Both the statements are incorrect. |

| C. | Statement – I is correct while Statement – II is incorrect. |

| D. | Statement – I is incorrect while Statement – II is correct. |

|

Option: C Explanation : Click on Discuss to view users comments. |