| A. | ₹25,000 |

| B. | ₹70,000 |

| C. | ₹1,00,000 |

| D. | ₹40,000 |

|

Option: A Explanation : Click on Discuss to view users comments. |

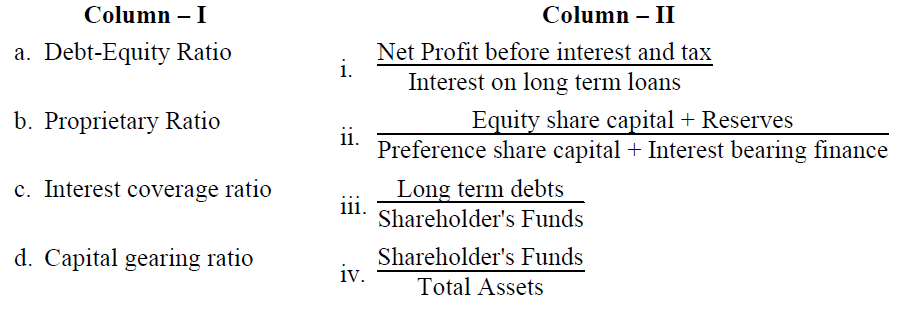

Match the items in Column – I with the items in Column – II and indicate the correct code :

| A. | i ii iii iv |

| B. | iii iv i ii |

| C. | iii iv ii i |

| D. | ii iii iv i |

|

Option: B Explanation : Click on Discuss to view users comments. |

| A. | ₹1,10,000 |

| B. | ₹27,500 |

| C. | ₹17,500 |

| D. | ₹70,000 |

|

Option: C Explanation : Click on Discuss to view users comments. |

| A. | Legal expenses incurred on the purchase of land. |

| B. | Expenses on a mega advertisement campaign while launching a new product. |

| C. | Expenses incurred on installation of a new machine. |

| D. | Wages paid for construction of an additional room in the building. |

|

Option: D Explanation : Click on Discuss to view users comments. |