UGC NET Paper1 Previous Year Solved Papers - 26th June 2019 Morning Shift

Read the following comprehension and answer the question.

Consider the following table that shows expenditures of a company (in lakh rupees) per annum

over the given years. Answer the questions based on the data contained in the table:

| Year | Salary | Transport | Bonus | Interest on Loans | Taxes |

| 2008 | 150 | 90 | 2.00 | 20.0 | 80 |

| 2009 | 180 | 100 | 2.50 | 30.5 | 95 |

| 2010 | 200 | 110 | 2.75 | 35.5 | 105 |

| 2011 | 240 | 115 | 3.00 | 40.0 | 85 |

| 2012 | 250 | 125 | 3.25 | 42.5 | 100 |

- Option : B

- Explanation : Total amount of bonus paid by the company

=2 + 2.5 +2.75 +3 + 3.25

= 13.5

Total amount of salary paid by the company

= 150+ 180+200+240+250

= 1020

Required percent = 13.5/1020 X 100 = 1.32%

Read the following comprehension and answer the question.

Consider the following table that shows expenditures of a company (in lakh rupees) per annum

over the given years. Answer the questions based on the data contained in the table:

| Year | Salary | Transport | Bonus | Interest on Loans | Taxes |

| 2008 | 150 | 90 | 2.00 | 20.0 | 80 |

| 2009 | 180 | 100 | 2.50 | 30.5 | 95 |

| 2010 | 200 | 110 | 2.75 | 35.5 | 105 |

| 2011 | 240 | 115 | 3.00 | 40.0 | 85 |

| 2012 | 250 | 125 | 3.25 | 42.5 | 100 |

- Option : D

- Explanation : Total expenditure on taxes for all the year

= 80 + 95 + 105 + 85 + 100 = 465

Total expenditure on transport for all the year

= 90 + 100 + 110+ 115 + 125 = 540

Required ratio = 465/540 - 31/36

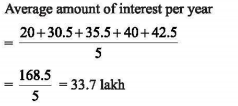

Read the following comprehension and answer the question.

Consider the following table that shows expenditures of a company (in lakh rupees) per annum

over the given years. Answer the questions based on the data contained in the table:

| Year | Salary | Transport | Bonus | Interest on Loans | Taxes |

| 2008 | 150 | 90 | 2.00 | 20.0 | 80 |

| 2009 | 180 | 100 | 2.50 | 30.5 | 95 |

| 2010 | 200 | 110 | 2.75 | 35.5 | 105 |

| 2011 | 240 | 115 | 3.00 | 40.0 | 85 |

| 2012 | 250 | 125 | 3.25 | 42.5 | 100 |

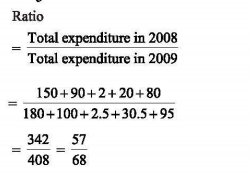

Read the following comprehension and answer the question.

Consider the following table that shows expenditures of a company (in lakh rupees) per annum

over the given years. Answer the questions based on the data contained in the table:

| Year | Salary | Transport | Bonus | Interest on Loans | Taxes |

| 2008 | 150 | 90 | 2.00 | 20.0 | 80 |

| 2009 | 180 | 100 | 2.50 | 30.5 | 95 |

| 2010 | 200 | 110 | 2.75 | 35.5 | 105 |

| 2011 | 240 | 115 | 3.00 | 40.0 | 85 |

| 2012 | 250 | 125 | 3.25 | 42.5 | 100 |

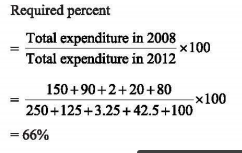

Read the following comprehension and answer the question.

Consider the following table that shows expenditures of a company (in lakh rupees) per annum

over the given years. Answer the questions based on the data contained in the table:

| Year | Salary | Transport | Bonus | Interest on Loans | Taxes |

| 2008 | 150 | 90 | 2.00 | 20.0 | 80 |

| 2009 | 180 | 100 | 2.50 | 30.5 | 95 |

| 2010 | 200 | 110 | 2.75 | 35.5 | 105 |

| 2011 | 240 | 115 | 3.00 | 40.0 | 85 |

| 2012 | 250 | 125 | 3.25 | 42.5 | 100 |