PREVIOUS YEAR SOLVED PAPERS - November 2017

31. Match the items of List-I with those of List- II and indicate the correct code:

| List-I | List-II |

| (a) ABC Analysis | (i) Dividend Decision |

| (b) Walter Model | (ii) Capital Budgeting Decision |

| (c) Capital Rationing | (iii) Capital Structure Decision |

| (d) Net Operating Income Approach | (iv) Working Capital Management Decision |

CODES

| (a) | (b) | (c) | (d) | |

| 1 | (i) | (iii) | (ii) | (iv) |

| 2 | (ii) | (i) | (iii) | (iv) |

| 3 | (iv) | (i) | (ii) | (iii) |

| 4 | (iii) | (i) | (ii) | (iv) |

32. Main objective of employing Financial Leverage is to:

- Option : D

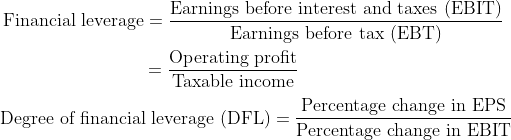

- Explanation : Financial leverage: Financial leverage is associated with financing activities of a firm. It represents the relationship between the firm’s earnings before interest and taxes (EBIT) (or operating profit) and earnings available to ordinary shareholders. Financial leverage is sometimes, known as trading on equity.

Definition: Financial leverage may be defined as the payment of fixed rate of interest for the use of fixed interest-bearing securities, to magnify the rate of return as equity shares. Financial leverages arise from the existence of fixed interest expenses. When a firm has fixed interest expenses, one per cent change in EBIT leads to more than one per cent change in PBT or PAT or EPS.

- Option : B

- Explanation : Internal Rate of Return (IRR): The discount rate on an investment that equates the present value of the investment’s cash outflows with the present value of the investment’s cash inflows. For instance, if you spend $50,000 on a given investment, the IRR per cent would be the annualized rate of return of the profit. It’s not just the annual rate of return per year multiplied by the number of years. If you loan $50,000 and get no interest the first year, but you get $20,000 in interest or return in the second year, you actually got about $10,000 each year, so the IRR is approximately 20 per cent.

35. Which one of the following is not true?

- A

Material resources are subject to laws of mechanics and they cannot have an output greater than the input.

- B

Human resources are capable of exponential growth and development.

- C

Human resources cannot yield an output that may be far greater than what the value of their input warrants.

- D

In current scenario, gradually, the emphasis has shifted from muscle power to use of mind power.

- Option : C

- Explanation : Management acts as a creative and invigorating force in the organization. It creates a result that is bigger whole than the sum total of efforts put in by the group. Management adds a real plus value to the operation of any industrial unit by enlisting a little extra value of each person. It provides new ideas, imaginations and visions to the group working and integrates its efforts in such a manner as to account for better results. Productive resources fall into two categories: material and human. Productivity of material resources becomes stagnant after the attainment of their rated capacity. But human resources are capable of tremendous growth and development, and they can yield an output that may be far greater than what the value of their input warrants. And this work of improving human capabilities is done by management. Urwick and Brech have rightly observed, “No ideology, no ‘ism’, no political theory can win a greater output with less effort from a given complex of human and material resources, only sound management.”