PREVIOUS YEAR SOLVED PAPERS - December 2018

| LIST-I | LIST-II |

| (a) Direct investment overseas aimed at manufacturing products not manufactured by the firm in the home country | (i) Inward FDI |

| (b) Direct investment in a foreign country aimed to sell the output of the firm’s domestic production. | (ii) Backward Vertical FDI |

| (c) Direct investment overseas aimed at providing inputs for the firms production process in the home country | (iii) Conglomerate FDI |

| (d) Foreign firms investing overseas and taking control over foreign assets | (iv) Forward Vertical FDI |

CODES

| (a) | (b) | (c) | (d) | |

| 1 | (iv) | (iii) | (ii) | (i) |

| 2 | (iii) | (iv) | (ii) | (i) |

| 3 | (i) | (iv) | (ii) | (iii) |

| 4 | (iii) | (ii) | (i) | (iv) |

- Option : B

- Explanation : Types of FDI

We distinguish between horizontal and vertical FDI. Horizontal FDI occurs when the MNE enters a foreign country to produce the same product(s) produced at home (or offer the same service that it sells at home). It represents, therefore, a geographical diversification of the MNE’s domestic product line. Most Japanese MNEs, for instance, begin their international expansion with horizontal investment because they believe that this approach enables them to share experience, resources, and knowledge already developed at home, thus reducing risk. If FDI abroad is to manufacture products not manufactured by the parent company at home, it is called conglomerate FDI. For example, Hong Kong MNEs often set up foreign subsidiaries or acquire local firms in Mainland China to manufacture goods that are unrelated to the parent company’s portfolio of products. The main purpose is to seize emerging-market opportunities and capitalize on their established business and personal networks with the mainland that Western MNEs do not have. Vertical FDI occurs when the MNE enters a foreign country to produce intermediate goods that are intended for use as inputs in its home country (or in other subsidiaries’) production process (this is called “backward vertical FDI”), to market its homemade products overseas, or to produce final outputs in a host country using its homesupplied intermediate goods or materials (this is called “forward vertical FDI”). An example of backward vertical FDI is offshore extractive investments in petroleum and minerals. An example of forward vertical integration is the establishment of an assembly plant or a sales outlet overseas.

| LIST-I | LIST-II |

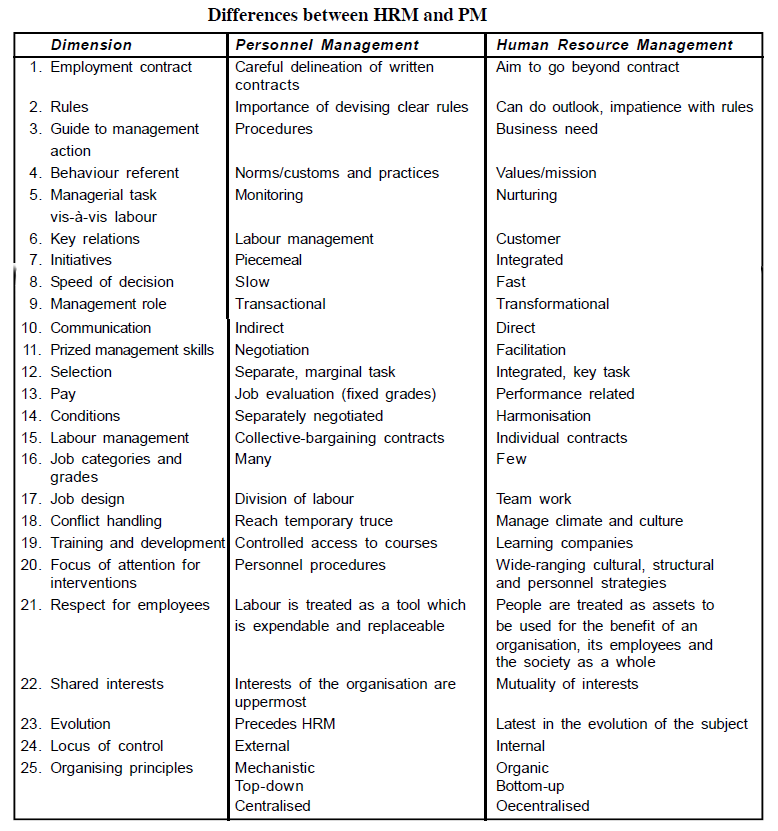

| (a) Behaviour referent | (i) Wide ranging cultural, structural and personnel strategies |

| (b) Focus of attention for interventions | (ii) Manage climate and culture |

| (c) Conflict handling | (iii) Few |

| (d) Job categories and grades | (iv) Values/mission |

CODES

| (a) | (b) | (c) | (d) | |

| 1 | (i) | (ii) | (iv) | (iii) |

| 2 | (iii) | (i) | (ii) | (iv) |

| 3 | (iv) | (i) | (ii) | (iii) |

| 4 | (iv) | (ii) | (i) | (iii) |

| List-I | List-II |

| (a) Mobile Defense | (i) Occupying the most desirable position in consumers’ minds, making the brand almost impregnable. |

| (b) Contraction Defense | (ii) The leader stretches its domain over new territories through market broadening and market diversification. |

| (c) Position Defense | (iii) Large companies give up weaker markets and reassign resources to stronger ones. |

CODES

| (a) | (b) | (c) | |

| 1 | (ii) | (iii) | (i) |

| 2 | (i) | (ii) | (iii) |

| 3 | (i) | (iii) | (ii) |

| 4 | (ii) | (i) | (iii) |

- Option : A

- Explanation : Kotler and Singh: have defined the following defensive strategies:

∎ A position defense is designed to defend a position by strengthening the firm’s brand power.

∎ A pre-emptive defense is an attempt to anticipate a competitive attack. This may involve covering every segment and niche within a market and flooding the market with products, targeting specific competitors before they can attack or indicating to the market the ways in which the leader intends to defend itself.

∎ A flank defense creates interventions in order to protect the leader’s position. For example, a competitor’s price attack on a firm’s brand may be responded to by introducing two new brands, one designed to be sold at the same price as the competitor’s brand, and the second at a lower price in order to outflank the competitor.

∎ A mobile defense involves market broadening. This usually involves an attempt to shift the emphasis from a specific product to the underlying need. An example is the repositioning of television companies as multimedia companies. An alternative to market broadening is market diversification, which involves the mergers of firms in wholly different industries into conglomerates.

∎ An alternative defense involves concentrating corporate resources in the areas of its greatest strength rather than defending all of the firm’s positions.

∎ A contraction defense involves a strategic withdrawal from specific areas of lesser strength.

∎ A counteroffensive defense may lead the organization to respond to a competitor’s price cuts in one market sector by slashing prices in another market sector considered to be more important to the competitor.

| LIST-I | LIST-II |

| (a) NPA | (i) The percentage of deposits to be kept with RBI in the form of cash. |

| (b) SLR | (ii) The rate at which RBI lends money to commercial banks. |

| (c) Repo Rate | (iii) Loans and advances not paid for more than 90 days. |

| (d) CRR | (iv) The percentage of net demand and time liabilities to be kept in the form of liquid assets. |

CODES

| (a) | (b) | (c) | (d) | |

| 1 | (iii) | (ii) | (iv) | (i) |

| 2 | (iii) | (iv) | (ii) | (i) |

| 3 | (iii) | (iv) | (i) | (ii) |

| 4 | (ii) | (iii) | (iv) | (i) |

- Option : B

- Explanation : Cash Reserve Ratio (CRR)

CRR is the most powerful tool to influence and control the monetary aggregates of the country. Under section 42(1) of RBI act, 1934, every scheduled commercial bank was required to maintain with the RBI every fortnight a minimum average daily cash reserve equivalent to 3% of its Net Demand and Time Liabilities (NDTL) outstanding as on the Friday of the previous week. The RBI is empowered to vary the CRR between 3% and 15%. RBI is using the CRR either to impound the excess liquidity or to release funds needed for the economy from time to time.

Statutory Liquidity Ratio (SLR)

Under section 24(b) of the Banking Regulation Act: 1949, every bank is required to maintain at the close of business every day, a minimum proportion of their Net Demand and Time Liabilities as liquid assets in the form of cash, gold and un-encumbered approved securities. The ratio of liquid assets to demand and time liabilities is known as Statutory Liquidity Ratio (SLR). The RBI is empowered to increase the SLR upto 40%.

Non-Performing (NPA)

RBI has defined NPA as follows (credit facility wise)

NPA - Term Loan: If interest and/instalment of principal remains overdue for a period of more than 180 days.

NPA - Cash credit & overdraft: A CC/OD account will have to be treated as NPA if account remains out of order for more than 180 days.

NPA - Bills purchased & Discounted: If the bill remains overdue for a period of more than 180 days.

Reverse Repo Rate

A Reverse Repo Rate is a rate that RBI offers to banks when they deposit their surplus cash with RBI for shorter periods. In other words, it is the rate at which the RBI borrows from the commercial banks. When banks have excess funds, but don’t have any other lending or investment options, they deposit/ lend the surplus funds with the RBI. This way banks can raise additional interest from their funds.

The reverse repo rate has an inverse relationship with the money supply in the economy. During high levels of inflation in the economy, the RBI increases the reverse repo. It encourages the banks to park more funds with the RBI to earn higher returns on idle cash. As a result, every excess rupee is put to use in banking system. Banks are left with lesser cash to extend loans, curbing the purchasing power of individuals.

Repo Rate

Repo rate refers to the rate at which commercial banks borrow money from the Reserve Bank of India (RBI) in case of shortage of funds. It is one of the main tools of RBI to keep inflation under control.