UGC NET COMMERCE July 2018 Q99

0. The due date of first instalment of advance tax by assessees other than companies is:

- Option : B

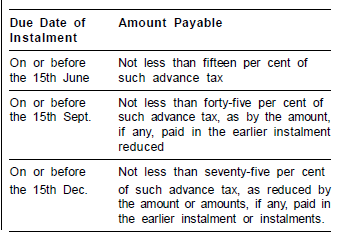

- Explanation : Section 211(1): Advance tax on the current income shall be payable by—all the companies, who are liable to pay the same, in four instalments during each financial year and the due date of each instalment and the amount of such instalment shall be as specified below: