UGC NET COMMERCE July 2018 Q96

0. Under the Income Tax Act, 1961 “block of assets” for the purpose of charging depreciation means:

- Option : C

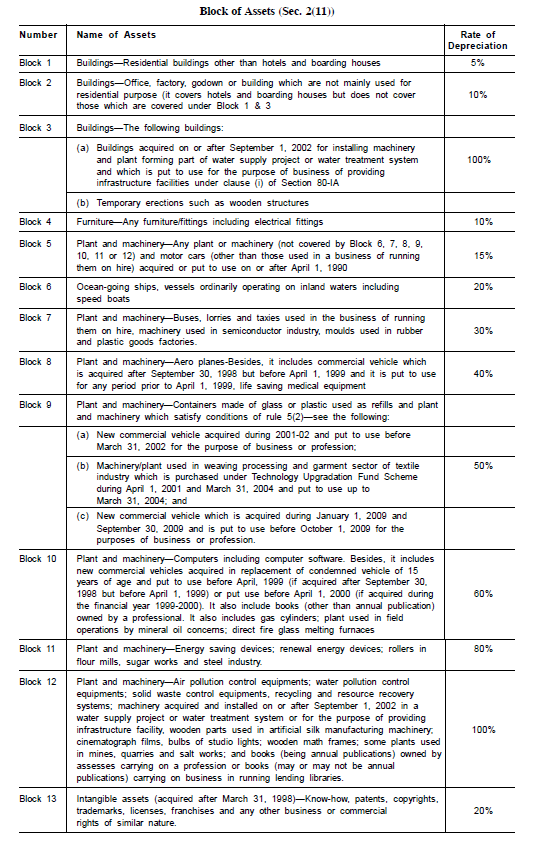

- Explanation : Meaning: As per Sec. 2(11) of the Income Tax Act, 1961, unless the context otherwise requires, the term “block of assets” means a group of assets falling within a class of assets comprising:

∎ Tangible assets, being buildings, machinery, plant or furniture;

∎ Intangible assets, being know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature, in respect of which the same percentage of depreciation is prescribed.

Concept of ‘Block of Assets’: Income Tax Act has prescribed different rates of depreciation for different types of block of assets. Depreciation on block of assets is mainly charged for the purpose of computing Capital Gains or Business Profit or Loss as per the Income Tax Act, 1961. The concept of block of assets, as explained above, requires working out depreciation in a manner that individual assets are sorted and assigned to the relevant/ respective block of assets in the year of purchase itself, based on the terminology prescribed under the Income Tax Act. The written down value needs to be worked out accordingly throughout the existence of that asset or the block, like Land and Buildings, Plant & Machinery, Motor Vehicles, Furniture and Fixtures, etc.

It means the assets which are having similar characteristics are collected together and one block is created. There are twelve block of assets as per The Income Tax Act, 1961, which are as follows: