UGC NET COMMERCE December 2018 Q77

0. Banks are required to classify Non-Performing Assets into

- Option : C

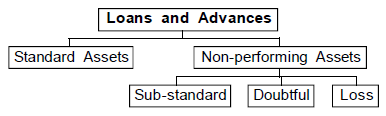

- Explanation : Bank’s loans and advances are to be classified into two broad categories — Standard and Non-Performing. Non-performing assets (NPA) are sub-divided into — Sub-standard; Doubtful and Loss assets.

Definitions

Standard Assets: Standard Asset is one which does not disclose any problems and which does not carry more than normal risk attached to the business. Such an asset should not be an NPA.

Sub-Standard Assets

(i) With effect from March, 2005 an asset would be classified as sub-standard if it remained NPA for a period less than or equal to 12 months. In such cases, the current net worth of the borrowers/ guarantors or the current market value of the security charged is not enough to ensure recovery of the dues to the banks in full. In other words, such assets will have well defined credit weaknesses that jeopard the liquidation of the debt and are characterised by the distinct possibility that the banks will sustain some loss, if deficiencies are not corrected.

(ii) An asset where the terms of the loan agreement regarding interest and principal have been re-negotiated or rescheduled after commencement of production, should be classified as substandard and should remain in such category for at least 12 months of satisfactory performance under the renegotiated or rescheduled terms. In other words, the classification of an asset should not be upgraded merely as a result of rescheduling, unless there is satisfactory compliance of this condition.

Doubtful Assets: With effect from March 31, 2005, an asset is required to be classified as doubtful, if it has remained NPA for more than 12 months. For Tier I banks the 12-months period of classification of a substandard asset in doubtful category will be effective from April 1, 2008. As in the case of sub-standard assets, rescheduling does not entitle the bank to upgrade the quality of an advance automatically. A loan classified as doubtful has all the weaknesses inherent as that classified as sub-standard, with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently known facts, conditions and values, highly questionable and improbable.

Loss Assets: A loss asset is one where loss has been identified by the NBFCs, or internal or external auditors, or the RBI inspection to the extent the amount has not been written off. Alternatively, it may be an asset that is adversely affected by a potential threat of non-recoverability due to either erosion in the value of the security/non-availability of security, or any fraudulent act/omission on the part of the borrower.