Manag., November-2017 – Q16

- Option : C

- Explanation : Objectives of Financial Management Financial management of any business firm has to set goals for itself and to interpret them in relation to the objective of the firm. Broadly, there are two alternative objectives a business firm can pursue viz.

> Profit Maximisation: Profit maximization is considered as an important goal in financial decision-making in an organization. It ensures that firm utilizes its available resources most efficiently under conditions of competitive markets. But in recent years, under the changed corporate environment, profit maximisa-tion is regarded as unrealistic, difficult, unappropriate and socially not much preferred goal for business organisation. Profit maximisation as corporate goal is criticised by scholars mainly on the following grounds:

(i) It is vague conceptually.

(ii) It ignores timing of returns.

(iii) It ignores the risk factor.

(iv) It may tempt to make such decision which may in the long run prove disastrous.

(v) Its emphasis is generally on short run projects.

(vi) It may cause decreasing share prices.

(vii) The profit is only one of the many objectives and variables that a firm considers.

> Wealth Maximisation: Presently, maximisation of present value (or wealth) of a course of action is considered appropriate operationally flexible goal for financial decision-making in an organisation. The net present value or wealth can be defined more explicitly in the following way.

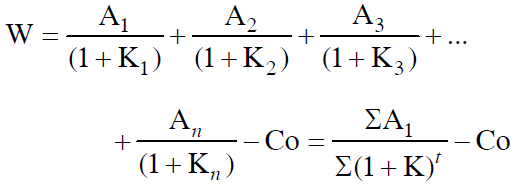

Where A1.... A2 represent the stream of benefits expected to occur if a course of action is adopted. Co is the cost of that action and K is the appropriate discount rate, and W is the Net present worth or wealth which is the difference between the present worth or wealth of the stream of benefits and the initial cost.

The management of an organisation maximises the present value not only for shareholders but for all including employees, customers, suppliers and community at large. This goal for the maximum present value is generally justified on the following grounds:

(i) It is consistent with the object of maximising owners economic welfare.

(ii) If focuses on the long run picture.

Goal Objective Advantages Disadvantages Profit Maximisation Large amount of profits 1. Easy to calculate profits 1. Emphasizes the short term 2. Easy to determine the link between financial decisions and profits 2. Ignores risk or uncertainty 3. Ignores the timing of returns 4. Requires immediate resources Shareholder wealth maximisation Highest market value of common stock 1. Emphasizes the long term 1. Offers no clear relationship between financial decisions and stock price 2. Recognizes risk or uncertainty 2. Can lead to management anxiety and frustration 3. Recognizes the timing of returns 4. Considers return