Manag., July-2018 – Q27

- Option : B

- Explanation :

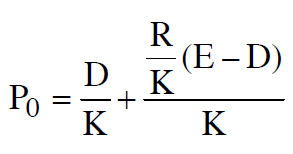

Walter’s formula to calculate the market price per share (P) is:

P = D/K + {R × (E – D)/K}/K, where

P = market price per share

D = dividend per share

E = earnings per share

R = internal rate of return of the firm

K = cost of capital of the firm

The mathematical equation indicates that the market price of the company’s share is the total of the present values of:

An infinite flow of dividends, and

l An infinite flow of gains on investments from retained earnings.

The formula can be used to calculate the price of the share if the values of other variables are available.

Assumptions of Walter’s Model

Walter’s model is based on the following assumptions:

Internal Financing: All the investments are financed by the firm through retained earnings. No new equity or debt is issued for the same.

Constant IRR and Cost of Capital: The internal rate of return (r) and the cost of capital (k) of the firm are constant. The business risks remain same for all the investment decisions.

Constant EPS and DPS: Beginning earnings and dividends of the firm never change. Though different values of EPS and DPS may be used in the model, but they are assumed to remain constant while determining a value. 100% Retention/Payout: All the earnings of the company are either reinvested internally or distributed as dividends. Infinite Life: The company has an infinite or very long life.