UGC NET COMMERCE July 2018 Q48

0. Profitability Index of a Project is the ratio of present value of cash inflows to:

- Option : C

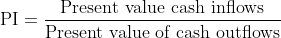

- Explanation : Profitability Index (PI) or Benefit-Cost Ratio (B/C Ratio): Yet another time-adjusted capital budgeting technique is profitability index (PI) or benefit-cost ratio (B/C). It is similar to the NPV approach. The profitability index approach measures the present value of returns per rupee invested, while the NPV is based on the difference between the present value of future cash inflows and the present value of cash outlays. A major shortcoming of the NPV method is that, being an absolute measure, it is not a reliable method to evaluate projects requiring different initial investments. The PI method provides a solution to this kind of problem. It is, in other words, a relative measure. It may be defined as the ratio which is obtained dividing the present value of future cash inflows by the present value of cash outlays. Symbolically,

This method is also known as the B/C ratio because the numerator measures benefits and the denominator costs. A more appropriate description would be present value index.

Accept-Reject Rule: Using the B/C ratio or the PI, a project will qualify for acceptance if its PI exceeds one. When PI equals 1, the firm is indifferent to the project. When PI is greater than, equal to or less than 1, the net present value is greater than, equal to or less than zero respectively. In other words, the NPV will be positive when the PI is greater than 1; will be negative when the PI is less than one. Thus, the NPV and PI approaches give the same results regarding the investment proposals.

The selection of projects with the PI method can also be done on the basis of ranking. The highest rank will be given to the project with the highest PI, followed by others in the same order.